Content

You hold each trade for a few hours to benefit from the significant price changes. The only similarity between scalpers and day traders is that both do not keep any trades open overnight and close all orders before the market closes. Bollinger bands are one of the best trading indicators for scalping as they enable scalpers to trade in volatile markets since all the positions are so rapid. The Bollinger bands scalping strategy helps traders identify when the market is going to reverse, providing them with the ideal exit and entry price levels. Volatility is favourable when trading derivatives, as it allows traders to profit from rising and falling market prices.

The exchange rate varies throughout the day, depending on a multitude of circumstances. While there is not one-size-fits all forex strategy that works for everyone, there are popular ones that increase the success rate if applied smartly. One such strategy is scalping and we will explain how it works. Late nights, flu symptoms, and so on, will often take you off your game. Stop trading if you have a string of losses and give yourself time to regroup. Scalping can be fun and challenging, but it can also be stressful and tiring.

Often, more experienced or institutional traders use strategies such as a scalping, arbitrage or high-frequency trading (HFT) to carry out quick transactions. There is a general consensus between traders for the best times to scalp forex, although this does depend on the currency. For example, trading a currency pair based on the GBP tends to be most successful throughout the first hour of the London trading session, mid-morning.

Charting & Indicators

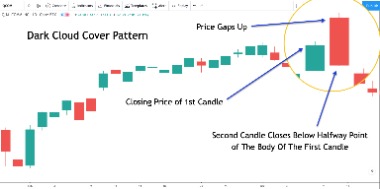

If the gap between the two conditions equals one candlestick, you can open a trade, but such a signal is considered as lagging. Don’t open multiple positions if the gap between the two conditions is two or more candlesticks or if MAs converge and then diverge instead of crossing each other. In the following AUD/JPY example, the arrows indicate points where a scalper would open a position, going long or short depending on the trend reversal. On a stochastic oscillator, when the solid black line – called the %K line – crosses the dotted red line – called the %D line – it’s a sign that a change in market direction is imminent.

But if you think that you’re already familiar with some of the material, to shorten your route, we present the table of contents of this article. In the system shown here, and there are many other systems you can use to trade profitably, we’ve included a three-period RSI with the plot guides set to 90% and 10%. Only trades on the short side once the RSI crosses over the 90% plot guide, and the long side once the RSI reaches below the 10% plot guide, are entered. Being able to “pull the trigger” is a necessary key quality for a scalper. This is especially true in order to cut a position if it should move against you by even two or three pips. Remember, though, that there are no easy get-rich-quick schemes in trading.

If you have had a string of losses, you can stop trading and take some time to recover. This is true for any form of trading, but since you are making so many trades in one day, it is particularly critical that you follow risk management guidelines. Because of their high trading volume, pairs like the EUR/USD, GBP/USD, USD/CHF, and USD/JPY have the tightest spreads. A stop order prevents trade from being executed if the loss exceeds your appropriate cap. Trading stops help you avoid major losses by allowing you to set a cap on how much you can lose on a contract. Chart patterns are visual representations of prices over several days.

What is price action scalping strategy ?

Markets experience high volatility around important market events. Economic data releases are the primary trigger for currency pair price fluctuations. Most of our traders analyse the market on a regular basis for upcoming events that may have an effect on their spread. Assume the trader has a $10,000 account and is willing to risk 0.5% of their account per trade.

However, the best time to trade any major currency pairs is generally throughout the first few hours of the New York trading session, as the USD has the highest trading volume. It goes without saying that traders do not monitor charts outside of forex trading hours. Forex scalping is a day trading style used by forex traders that involves buying or selling currency pairs with only a brief holding time in an attempt to make a series of quick profits. A forex scalper looks to make a large number of trades, taking advantage of the small price movements, which are common throughout the day.

Is Scalping Profitable?

You can begin trading as soon as you have money in the account and set up the platform. However, there are several concepts and practices you should become familiar with before trading. The size of the position is how many lots you purchase—lots come in micro, mini, and standard lots. You determine the type of position, size, and acceptable risk levels based on your account balance, preferences, and risk tolerance. Now let’s take a look at the contents of this article where forex scalping is discussed with all its details, advantages and disadvantages. Our suggestion is that you peruse all of this article and absorb all the information that can benefit you.

But with such speed and taking small numbers of pips, your trading will be different compared to longer-term traders. For example, spreads will have a higher impact on your profitability. You may be more restricted with the Forex pairs and times of day you choose to trade. You may even need to alter your computer setup to cope with the extra demands of Scalping.

Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Named after John Bollinger, who created them in the 1980s, Bollinger Bands are good for identifying assets that have deviated from the mean. A Bollinger Band chart is very effective at showing the volatility of the market and that is crucial for forex scalpers because their trades are so quick, usually less than 5 minutes.

- When a market maker buys a position they are immediately seeking to offset that position and capture the spread.

- This is a short-term transaction to buy or sell a currency at the time of an important news release, for example, the publication of a GDP report or a change in the interest rate.

- Instead of opening one position at the start of a trend and closing it at the end, scalpers will open and close several positions over a trend’s course.

- However, while a day trader may look to take a position once or twice, or even a few times a day, scalping is much more frenetic and will trade multiple times during a session.

Liquidity determines whether the trade will be executed at the desired price and with a low spread. A position is executed only after the expectations of the buyer and the seller regarding the price match. Therefore, the risks that a seller won’t meet a buyer are low. If the market is illiquid, it may take time for a trade to be executed.

Any forex scalping strategy should include sound risk management, with stops vital to avoid larger losses that can quickly erase many small wins. Some forex pairs, such as AUD/JPY, GBP/EUR and USD/MXN, are more volatile due to their decreased liquidity, as well as economic factors like trade agreements, exports and natural resources. Forex scalpers should try to trade currency pairs that have high liquidity so that can get out of a position quickly. Forex scalping and trading are vastly different than investing.

The Advantages and Disadvantages of Forex Scalping

If you’re glued to the screen, there’s no need to place pending orders. If you need to leave your workplace for some time, then place stop loss. Until then, orders can be rearranged or “disassembled” by orders placed on the other side. Wait until the take profit is triggered to open and close the trade when the volume is exhausted or moved. Let’s say that a trend is clearly visible on the market – an uptrend or a downtrend. Prices are rising, and delta shows that sellers or buyers dominate the market.

In other markets, liquidity often means stability, but forex is highly volatile. This means major short-term price movements can happen at any time, which can cause the value of currencies to spike up and down in seconds. This volatility presents opportunities for greater profits – another reason why scalpers often favour forex. But conversely, this can also lead to an increased exposure to risk. Scalping can be very profitable for traders with a strict exit strategy.

Many of us pursue trading merely as an additional income source, and would not like to dedicate five six hours every day to the practice. In order to deal with this problem, automated trading systems have been developed, and they are being sold with rather incredible claims all over the web. We do not advise our readers to waste their time trying to make such strategies work for them; at best you will lose some money while having some lessons https://g-markets.net/helpful-articles/dragonfly-doji-definition/ about not trusting anyone’s word so easily. This approach, to be sure, is not for everyone, but it is certainly a worthy option. Scalping also demands a lot more attention from the trader in comparison to other styles such as swing-trading, or trend following. It may appear to be a formidable task at first sight, but scalping can be an involving, even fun trading style once the trader is comfortable with his practices and habits.

Depending on volatility, the trader typically risks four pips and takes profit at eight pips. The reward is twice the risk, which is a favorable risk/reward. If volatility is higher than usual, the trader will risk more pips and try to make a larger profit, but the position size will be smaller than with the four pip stop loss. Due to the increased volatility, position sizes may be scaled down to reduce risk. While a trader may attempt to usually make 10 pips on a trade, in the aftermath of a major news announcement they may be able to capture 20 pips or more, for example.

- These are the three core components that for a complete trading strategy.

- In this lesson, we walk through key pieces of tech gear that effect every scalper.

- The risk of scalping in Forex also lies in a sharp change in the exchange rate, for example, during the release of important economic news.

- This means that they tend to place lots of small bets throughout the day and constantly monitoring the price levels of each trade.

- The most popular Forex scalping strategy is channel trading during high-liquidity assets’ highest volatility period.

For example, three candlesticks yielded nearly 11 points in short positions for 4-digit quotes in the M5 chart of the EURUSD. It corresponds to 10 USD for a 0.1 lot trade with a spread of 1 point. The Stochastics indicator is an oscillator which signals overbought market conditions when its value crosses above 80, and oversold market conditions when its value crosses below 20.

That is, there should be high volatility in a short period as the scalper’s earnings depend on the size of the volatility. CFDs also give you an opportunity to trade an asset without ever taking ownership of it by simply speculating on its price direction. Additionally, when you are scalping with CFDs, you don’t have to pay financing interest, as you don’t hold any positions overnight. Traders who implement this strategy are referred to as scalpers.